HOME | RESOURCES | INCENTIVES | GALLERY | FAQ | CONSULTATION

HOMEOWNERS GUIDE:

FEDERAL TAX CREDITS

STATE OF MARYLAND:

SOLAR INCENTIVES

2024 SOLAR INCENTIVES,

CREDITS, AND MORE

HOMEOWNERS GUIDE TO FEDERAL TAX CREDITS

WHAT IS A TAX CREDIT?

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000

WHAT IS THE FEDERAL SOLAR TAX CREDIT?

* The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer.

* The installation of the system must be complete during the tax year.

* Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2022-2032.4 It will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. The tax credit expires starting in 2035 unless Congress renews it.

* There is no maximum amount that can be claimed.

AM I ELIGIBLE TO CLAIM THE FEDERAL SOLAR TAX CREDIT?

You might be eligible for this tax credit if you meet all of the following criteria:

* Your solar PV system was installed between January 1, 2017, and December 31, 2034.

* The solar PV system is located at a primary residence of yours in the United States.

* You purchase interest in an off-site community solar project, if the electricity generated is credited against, and does not exceed, your home’s electricity consumption. Note: you would not qualify if you only purchase the electricity from a community solar project.

* You own the solar PV system (i.e., you purchased it with cash or through financing but you are neither leasing the system nor paying a solar company to purchase the electricity generated by the system).

* The solar PV system is new or being used for the first time. The credit can only be claimed on the “original installation” of the solar equipment.

WHAT EXPENSES ARE INCLUDED?

The following expenses are included:

* Solar PV panels or PV cells used to power an attic fan (but not the fan itself).

* Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

* Balance-of-system equipment, including wiring, inverters, and mounting equipment

* Energy storage devices that have a capacity rating of 3 kilowatt-hours (kWh) or greater. If the storage is installed in a subsequent tax year to when the solar energy system is installed it is still eligible, however, the energy storage devices are still subject to the installation date requirements.

* Sales taxes on eligible expenses.

HOW DO OTHER INCENTIVES I RECEIVE AFFECT THE FEDERAL TAX CREDIT?

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website at www.dsireusa.org.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system installed in 2022 cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows: ($18,000 - $1,000) 0.30 = $5,100

However, payments from a public utility to compensate for excess generated electricity not consumed by the taxpayer but delivered to the utility’s electrical grid (for example, net metering credits) are not subsidies for installing qualifying property and do not affect the taxpayer’s credit qualification or amounts.

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated (either upfront or over time), the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

Unlike utility rebates, rebates from state governments generally do not reduce your federal tax credit. For example, if your solar PV system was installed in 2022, installation costs totaled $18,000, and your state government gave you a one-time rebate of $1,000 for installing the system, your federal tax credit would be calculated as follows: $18,000 0.30 = $5,400

State Tax Credit

State tax credits for installing solar PV generally do not reduce federal tax credits—and vice versa. However, when you receive a state tax credit, the taxable income you report on your federal taxes may be higher than it otherwise would have been because you now have less state income tax to deduct. The end result of claiming a state tax credit is that the amount of the state tax credit is effectively taxed at the federal tax level.

CAN I CLAIM THE CREDIT, ASSUMING I MEET ALL REQUIREMENTS, IF ...

…I am not a homeowner? Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

…I installed solar PV on my vacation home in the United States? Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48.

…I am not connected to the electric grid? Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

…the solar PV panels are on my property but not on my roof? Yes. The solar PV panels located on your property do not necessarily have to be installed on your roof, as long as they generate electricity for use at your residence.

…I have a home office (or my residence is also used for a commercial purpose)? Yes, but if the residence where you install a solar PV system serves multiple purposes (e.g., you have a home office or your business is located in the same building), claiming the tax credit can be more complicated. When the amount spent on the solar PV system is predominantly used for residential rather than business purposes, the residential credit may be claimed in full without added complications. However, if less than 80% of the solar PV system cost is a residential expense, only the percentage that is residential spending can be used to calculate the federal solar tax credit for the individual’s tax return; the portion that is a business expense could be eligible for a similar commercial ITC on the business’s tax return.

…I financed my solar PV system instead of paying for it upfront? (If so, how do I treat interest, origination fees, and extended warranty expenses?) Yes. If you financed the system through the seller of the system and you are contractually obligated to pay the full cost of the system, you can claim the federal solar tax credit based on the full cost of the system. Miscellaneous expenses, including interest owed on financing, origination fees, and extended warranty expenses are not eligible expenses when calculating your tax credit.

…I bought solar panels but have not installed them yet? No. The tax credit is only for systems for which installation was complete during the year.

…I participate in an off-site community solar program? The answer depends heavily on your specific circumstances. The IRS states in Questions 25 and 26 in its Q&A on Tax Credits that off-site solar panels or solar panels that are not directly on the taxpayer’s home could still qualify for the residential federal solar tax credit under some circumstances. However, community solar programs can be structured in various ways, and even if you are eligible for the tax credit, it may be difficult to claim due to other tax rules. For example, one arrangement is the creation of a “special purpose entity,” where community members form and invest in a business that operates the community solar project. If your participation is limited to investing in the community solar project and you do not participate in the operation of the project on a regular, continuous, and substantial basis, you are constrained in taking advantage of the credit because you are considered a “passive investor.” IRS rules require that a tax credit associated with a passive investment only be used against passive income tax liability, which only applies to income generated from either a rental activity or a business in which the individual does not materially participate. Many homeowners will therefore not have passive income against which the credit can be claimed.

OTHER FREQUENTLY ASKED QUESTIONS

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Is there a dollar or lifetime limit on the federal solar tax credit? No, there is neither a dollar limit nor is there a lifetime limit on the tax credit. The credit is only limited to 30% of qualified expenditures made for property placed in service in a given year.

Can I qualify for the tax credit if the property installed has been used by another individual? No. Used property is not eligible for the federal solar tax credit.

Is the cost of a roof replacement eligible for a tax credit? Sometimes. Traditional roof materials and structural components that serve only a roofing or structural function do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve both the functions of solar electric generation and structural support and such items may qualify for the credit.

Can I use the tax credit against the alternative minimum tax? Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2022 but I did not move in until 2023. May I claim a tax credit if it came with solar PV already installed? Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house (assuming the builder did not claim the tax credit)—in other words, you may claim the credit in 2023. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

HOW DO I CLAIM THE FEDERAL SOLAR TAX CREDIT?

After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach IRS Form 569522 to your federal tax return (Form 1040 or Form 1040NR). Instructions on filling out the form are available at http://www.irs.gov/pub/irs-pdf/i5695.pdf.

WHERE CAN I FIND MORE INFORMATION?

Internal Revenue Service (IRS), 1111 Constitution Avenue, N.W., Washington, D.C. 20224, (800) 829-1040. www.irs.gov.

Database of State Incentives for Renewables and Efficiency entry on “Residential Renewable Energy Tax Credit” at www.dsireusa.org.

Disclaimer: This guide provides an overview of the federal investment tax credit for residential solar photovoltaics (PV). It does not constitute professional tax advice or other professional financial guidance and may change based on additional guidance from the Treasury Department. This guide should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

STATE OF MARYLAND:

SOLAR INCENTIVES

RPS GOALS

Maryland increased our Renewable Portfolio Standard (RPS) target of 25 % renewable energy by 2020 to 50 % by 2030. In 2019, Governor Larry Hogan proposed the Clean and Renewable Energy Standard (CARES) that sets the state on a path to 100% clean electricity by 2040 with zero carbon emissions.

Maryland has quadrupled our solar energy capacity from 258 megawatts to 1,000 megawatts. We are very proud of this milestone and the role that the State has played to help promote solar energy. Maryland offers programs that support residential, commercial and community solar projects. The State offers solar grants to help residents, businesses, nonprofits and local government organizations.

INCENTIVES

FEDERAL

The Federal Business Energy Investment Tax Credit allows 30% tax credit for installed solar energy systems placed in service after December 31, 2019.

* The Modified Accelerated Cost-Recovery System (MACRS) allows businesses to recover investments in solar technologies through depreciation deductions as five-year property under the MACRS.

* The Federal Residential Renewable Energy Tax Credit allows taxpayers to claim a credit of 30% of qualified expenditures for a solar energy system that serves a residence. Systems must be placed in service by December 31, 2019. Incentives are less after 2019.

MARYLAND

A Maryland-Eligible Renewable Energy Credit (REC) is equal to the environmental attributes associated with 1 megawatt-hour (1,000 kilowatt-hours) of energy generated by a qualified renewable energy system. For example, if a solar array produces 4,000 kWh over the course of a year, the system owner will receive 4 Solar RECs (SRECs). RECs are entirely separate from the energy generated by a renewable energy facility. RECs have monetary value and can be sold or traded to meet a supplier’s annual compliance obligations as part of Maryland’s Renewable Portfolio Standard (RPS).

Electricity suppliers must purchase and retire SRECs in order to meet their compliance obligations under the law, or pay a Solar Alternative Compliance Payment for any SREC purchase shortfalls. Monetary value from the sale of RECs is typically used to help drive down the cost of deploying renewable energy technologies. More information on how RECs work in the context of Maryland’s RPS can be found on the Public Service Commission's FAQ Page. The Maryland Public Service Commission (PSC) receives and reviews all applications for qualified renewable energy technologies.

APPLICATIONS

Register your solar facility with the MD PSC only after completion and interconnection of your solar energy system. Solar installers typically help you navigate this process.

Instructions and applications to register your solar facility with the MD PSC can be found here: http://www.psc.state.md.us/electricity/solar-renewable-portfolio-standard-documents-rps/.

Once a state certification is provided by the PSC, system owners must then register their system in the PJM Interconnection’s Generator Attribute Trading System (GATS) within 30 days.

ADDITIONAL INFORMATION

* Frequently Asked Questions:

* Information on Solar Renewable Energy Certificates (SREC):

(a) SRECs have a useful life of three years.

(b) SREC quantities for PV systems under 10 kW are calculated from PVWatts model estimates.

(c) For PV systems over 10 kW, SRECs are paid based on actual production.

* PJM GATS offers helpful information on selling RECs, which can be found here, including:

(a) How the REC owner can advertise his credits on the GATS Bulletin Board or check-out the Buyer's Bulletin Board for specific purchase requests.

(b) How the REC owner can use an aggregator or broker to either purchase the RECs directly, or to assist the REC owner in finding a buyer.

(c) Finally, the REC owner could use an auction or exchange platform to sell RECs.

CLEAN ENERGY GRANTS

(a) MEA offers grants for clean energy systems installed at primary residences in Maryland through its Residential Clean Energy Grant Program

(b) MEA offers grants for clean energy systems installed at businesses, local governments, and non-profits through its Commercial Clean Energy Grant Program

CLEAN ENERGY PRODUCTION TAX CREDIT

(a) For systems online before December 31, 2015, MEA’s Clean Energy Production Tax Credit offers Marylanders a state income tax credit for electricity generated by solar PV systems (over 20 kW) of 0.85 cents per kWh.

(b) These credits can be claimed over a period of five years. Please visit MEA’s Production Tax Credit page for more information on the program.

For questions, contact us at (410) 537-4000 or 1-800-72-ENERGY or via email at [email protected]

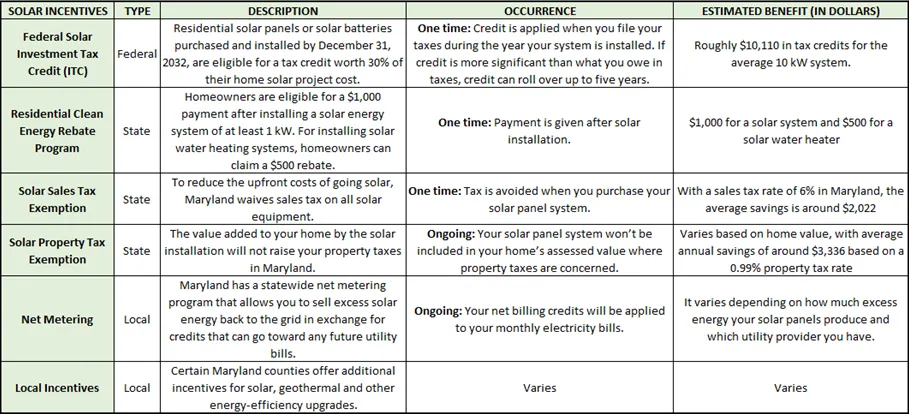

2024 SOLAR INCENTIVES, CREDITS, AND MORE

2024 Solar Incentives, Credits, And More

Do Maryland Solar Incentives Make It Affordable for Homeowners to Go Solar?

The average solar installation in Maryland costs $33,700 before applying solar incentives, which is much higher than the national average of $29,970.

However, this is based on the presumption that Maryland residents are installing more solar panels — usually a 10 kilowatt (kW) system — than average to meet their high-energy demands. The average American household uses a 9 kW system.

Maryland solar costs may be high, but energy prices in Maryland being higher than average, switching to solar yields far greater savings than in the average state. Plus, with the federal solar tax credit, state solar rebate program, tax exemptions and more, Maryland residents can offset their total solar installation costs by well over 30 to 40%.

Many homeowners have been finding it’s well worth it to go solar in Maryland, with a big boost of homeowners installing solar since 2014.1

Maryland’s Renewable Portfolio Standard (RPS) requires 50% of overall electricity generation sales in the state to be met by renewable energy resources by 2030, including a solar carve-out at 14.5% by 2028. So we anticipate these incentives will stick around.

Here’s an overview of current solar incentive programs available in Maryland:

What Do Maryland Residents Need to Know About the Federal Solar Tax Credit?

The federal solar investment tax credit (ITC) is the best financial incentive available in Maryland in our opinion, worth a whopping $10,110 for the average solar panel installation. However, credit values will vary depending on the size and cost of your solar panel system — calculating your IRA return is the ideal way to get a better estimate.

If you already have solar panels but are looking to install a solar energy storage system, you can also use the ITC to claim 30% back on that purchase starting in 2024.

It’s also important to realize that your tax credit won’t come as a check. Instead, it’s a deduction on the federal taxes you already owe. If you don’t owe 30% of your solar system’s cost in the tax year you installed the panels, the credit rolls over up to five years.

Maryland taxpayers who install solar panels have been able to take advantage of the ITC since it was created back in 2005. But the credit has seen several changes since then.

Most recently, in August of 2022, we saw the tax credit bump from 26% back up to 30% of the system value thanks to the passage of the Inflation Reduction Act, which has renewed the ITC’s availability at the following rate schedule:

* 30% of your total system value for solar photovoltaic (PV) systems installed between 2022 and 2032

* 26% of your total system value for solar PV systems installed in 2033

* 22% of your total system value for solar PV systems installed in 2034

* Credit discontinued for systems installed starting in 2035, unless extended again by Congress

Needless to say, if you’re thinking about installing solar panels in Maryland, you’re better off doing it sooner rather than later. How to Claim the Federal ITC in Maryland

Follow these five steps to claim your federal solar tax credit in Maryland:

(1) Download IRS Form 5695. This residential energy tax credit form can be downloaded straight from the IRS.

(2) Calculate your credit on Part I of the tax form (a standard solar energy system will be filed as “qualified solar electric property costs”). On line 1, enter your overall project costs as written in your contract, then complete the calculations on lines 6a and 6b.

(3) If solar is your only renewable energy addition, and you don’t have any rollover credit from the previous year, skip down to line 13.

(4) On line 14, calculate any tax liability limitations using the Residential Energy Efficient Property Credit Limit Worksheet.

(5) Then, complete calculations on lines 15 and 16. Be sure to enter the figure from line 15 on your Schedule 3 (Form 1040), line 5.

Opinion on the Federal ITC in Maryland

Too many people — solar users or otherwise — leave money on the table during tax season because of the confusion that comes with filing. We strongly recommend working with your solar company and a tax professional to make sure that doesn’t happen to you!

Although the cost of going solar has dropped 52% in Maryland over the last decade, it’s still a big investment.6 Being able to shave $10,000 or more off of the total cost of your system can make a huge difference come tax season. That takes the average $33,700 system down to a more affordable $23,590.

Additionally, because the ITC is offered nationwide it’s widely understood by most tax professionals and not too complicated to claim.

The downside? The federal tax credit only makes sense if you owe several thousand dollars in federal taxes over the next five years.

What You Need to Know About Maryland’s Residential Clean Energy Rebate Program

The state of Maryland has one of the most simple solar incentives in the nation to understand. The state will pay you a flat $1,000 if you install a solar panel system or solar roof shingles of at least 1 kW. That’s it, simple as that.

There are a few stipulations, though. First, the solar project must be installed at your primary residence and be completed by an installer certified by the North American Board of Certified Energy Practitioners (NABCEP).

Here’s a full list of eligibility requirements, per the Maryland Energy Administration (MEA):

* Application must be submitted to the MEA within 12 months of installation.

* The installation property must be a residential property and the primary residence of the applicant at the time of application.

* Project size must exceed: Solar Photovoltaic: 1 kW Geothermal: 1 ton Solar Water Heating: 10 sq. ft.

* The property may not be held in an irrevocable trust.

The biggest downside is that, according to the application process, your solar project must be paid for in full to claim the credit.

How to Claim Maryland’s Residential Clean Energy Rebate

You must submit an application on the MEA website to claim your $1,000 rebate and it is awarded on a first-come, first-served basis. You can visit the MEA website for more information or go to the application page.

Once you get onto the application page, here’s what you’ll need to do:

* Provide information about yourself, the installation (property, system, contractor), and the required permits.

* Submit photos showing all components of the installed clean energy system. If the system is a roof-mounted PV or SWH system, the photograph must clearly demonstrate where the system has been installed, with all panels or collectors clearly visible.

* Submit proof that the project is paid for in full (a copy of the final invoice showing a zero balance).

* Submit copies of all issued inspection and permit documents as provided by the local authority having jurisdiction (a ‘Passed Final Inspection’ report, sticker or picture).

* Submit proof that the install address is at your primary residence. MEA accepts the State Department of Assessments and Taxation (SDAT) Real Property Data Search printout showing the R-CERP applicant as owner and principal resident of the home where the system is installed.

Opinion on the Residential Clean Energy Rebate in Maryland

Maryland’s residential clean energy grant program is an amazing incentive that very few other states offer. It’s essentially a $1,000 “thank you” from the state just for switching to solar resources. Technically you only need to install 1 kW of solar to get the $1,000, which would only cost you $3,370 in Maryland. But a system that small wouldn’t offset much of your energy needs.

Just remember — you won’t be eligible for this incentive if you lease your solar panels. While paying for your solar panels in cash gives you the most energy savings, it’s a huge investment that not every Maryland resident can afford to do in the same calendar year. If you opt for a solar loan, most MD homeowners pay their systems off with savings between 8 and 14 years.

What You Need to Know About the Energy Storage Income Tax Credit in Maryland

To help residents afford solar storage technology, Maryland instituted a statewide energy storage tax credit. Residents were able to claim up to 30% of the cost of an energy storage system on their state returns.

The state capped this credit at $5,000 for residential properties (for context, some of the top-rated solar batteries cost around $10,000). Commercial solar installations, however, could claim a credit of up to $150,000, depending on the size of the solar panel system.

Unfortunately as of August 2024, all of the funds allocated for the energy storage tax credit have been claimed. It is doubtful the state will renew the incentive.

Opinion on Maryland’s Energy Storage Income Tax Credit

This was an awesome incentive that encouraged homeowners to go beyond creating their own renewable energy, but storing and relying on it as well. Unfortunately, the funds have all been allocated as of August 2024 and there’s no word on if the incentive will come back.

However, you can still claim a 30% solar battery rebate from the federal government starting in 2024, thanks to the Inflation Reduction Act.

Solar Sales Tax Exemption in Maryland

All home solar equipment is exempt from Maryland’s 6% sales tax. While this may not seem like a huge benefit, the sales tax exemption leads to a savings of roughly $2,022 for the average $33,700 solar panel system in Maryland.

How to Claim the Solar Sales Tax Exemption in Maryland

The sales tax exemption is automatically applied to all solar equipment purchases in Maryland, so you don’t have to take any extra steps to claim it.

Opinion on Maryland’s Solar Sales Tax Exemption

You don’t have to pay taxes on a solar equipment purchase in Maryland, saving you more than a thousand dollars on your purchase. What’s not to like?

Solar Property Tax Exemption in Maryland

Solar panels have been shown to increase home value in Maryland, but fortunately, your property taxes won’t budge. That’s thanks to Maryland’s solar property tax exemption. While most home improvement projects — like an inground pool — would raise your annual property taxes, your solar panels won’t be included in your home value assessment thanks to this law.

It’s hard to quantify exactly how much you’ll save with the property tax exemption because it’s based on your home value, where you live and how many solar panels you install. But here are some numbers we can gather: The average home value in Maryland is $402,625 The statewide property tax rate in Maryland is 0.99%

This leads to average annual savings of around $333 if you take the average system cost of $33,700 in the state. But of course, you can expect these numbers to be greater or lesser depending on the average home price in your city. For example, savings will be greater in Harford or Somerset.

How to Claim Maryland’s Property Tax Exemption

You don’t have to take any extra steps to claim the solar property tax exemption in Maryland.

Opinion on the Property Tax Exemption in Maryland

We wouldn’t want anyone to second-guess improving their home because they’re worried about their property taxes increasing. Not every state exempts solar users from a property tax increase, so we applaud Maryland for implementing this incentive.

Net Metering in Maryland

Net metering is a solar incentive that credits solar customers for the excess electricity generated by their panels during the day. Most solar arrays produce more energy than one home can consume at any given time when the sun is up.

Think of net metering like a backup battery — it’s a way to store the excess energy your system produces so none goes to waste.

In Maryland, if you route the excess electricity back to the local electric grid, you can receive compensation for that power at the full retail rate, offsetting a huge chunk of your electric bills.

Contrary to most states, where individual electric companies set their own net metering rates (often for less than the retail price of electricity), Maryland has an awesome net metering program that requires utility companies to reimburse customers dollar-for-dollar on the excess electricity they return. This is the best-case scenario for homeowners considering solar. Recently, the rules changed to let you continue to accrue credits or take a payout at the end of each year, which gives you more options to save based on your electricity consumption.

How to Enroll in Net Metering in Maryland

After you install solar panels, your utility company should come to your home to install a meter that keeps track of how much energy your panels produce and send to the grid, as well as how much energy you pull from the grid.

Your solar company should work with your utility to get the net metering process started, but we recommend that you take the following steps to ensure things go smoothly with your net energy metering connection.

Step 1: Speak with your electricity provider to ensure you have the correct meter installed. If you don’t, request the installation (it should be free).

Step 2: Proceed with installing your home solar energy equipment.

Step 3: Once your system is commissioned, we recommend monitoring your energy bills for a month or two to ensure that the credits are appearing.

Opinion on Net Metering in Maryland

Maryland’s net metering compensation rate is one of the highest in the country. As many states begin to roll back their net metering rates, Maryland’s continues to go strong. While it’s hard to calculate exactly how much NEM is likely to save you over your system’s lifespan, it can help push you toward eliminating your electric bills entirely.

We suggest Maryland homeowners install solar sooner rather than later to fully take advantage of this incentive before any potential changes take shape. The state is currently running a pilot program on its current form of net metering, so changes are due to take shape soon.

Local Solar Incentives in Maryland

Certain counties, municipalities and utilities may help you further lower the cost of going solar with individualized incentives.

Below are some of the ones we’ve found, but if you don’t see anything familiar to you on this list, we encourage you to ask your solar installer what might be available.

Anne Arundel County Solar Tax Credits: One-time property tax credit of up to $2,500 for residential homes that use solar energy for heating and cooling, water heating, and electricity generation. Visit Anne Arundel County’s website for more information.

Baltimore County Solar Tax Credits: Property Tax Credit up to $5,000 for property owners who use solar energy for heating and cooling, water heating and energy generation. The credit applies to single and multi-family dwellings. Go to Baltimore County Government’s website to learn more (Note: there is a waiting list for new applicants).

Harford County Solar Tax Credits: Property tax credit of up to $2,500 for property owners who utilize solar energy for heating and cooling, water heating and energy generation. The credit applies to residential and non-residential buildings. Learn more at Harford County’s Property Tax Credits website.

Prince George’s County Solar Tax Credits: Alternative Energy tax credit of up to $5,000 for installation or construction of solar energy devices in residential structures. Visit Prince George’s County web page for more information.

What Maryland Residents Need To Know About SRECs

In 2019, Maryland aggressively raised its Renewable Portfolio Standard (RPS) target from 25% to 50% by 2030. This means the state has a goal to generate 50% of its energy through renewables by 2030. Under the RPS standard, both Maryland’s government and its utility companies are being held to these goals.

As part of its plan to achieve this target, Maryland is rewarding property owners who contribute to the state’s RPS by installing solar. For each megawatt-hour (mWh) — or 1,000 kilowatt-hours — of clean energy generated by your home solar system, you can earn one solar renewable energy certificate (SREC).

SRECs are a complex yet effective solar incentive. Maryland residents can sell their certificates on the SREC market or sell them to power companies. The value of these certificates typically ranges from about $5 to $20 in Maryland, and many homeowners use the extra cash to help offset the cost of going solar. The average homeowner may earn about ten SRECs per year.

Are SRECs Taxable in Maryland?

Yes, SRECs are taxable for both your federal and state tax returns. You’ll typically report these sales on Form 1099-MISC, but again, we recommend working with a tax professional to make sure you file correctly.

Which Tax Incentives Are Best in Maryland?

At this point, we’ve covered all the incentives, but you may not be eligible or able to claim all of them. In our opinion, these are the Maryland solar incentives you should prioritize applying for or getting set up ASAP.

Federal Solar Tax Credit:

This is Maryland’s largest solar benefit, worth a whopping 30% of your total solar system price. Applying won’t take you too much time and it can shave thousands of dollars off of your solar investment.

Maryland Net Metering:

We love that Maryland offers a generous net metering program that reimburses customers dollar-for-dollar on the excess electricity they return. Even better, you shouldn’t have to do much to have net metering set up!

Maryland’s Clean Energy Rebate:

Getting $1,000 in cash just for installing solar panels is a pretty sweet deal, but it does come with the high cost of having to pay for your entire system upfront.

Local Tax Credits:

If you live in one of the countries mentioned under the local incentive section, you could be eligible for $2,500 to $5,000 in tax credit deductions on top of the federal ITC.

SRECs:

SRECs are complicated, but are an extremely valuable incentive for Maryland’s homeowners. Given that the average homeowner can generate enough electricity to earn an SREC in about one month, that can earn a little over $100 per year given the current rate of SRECs.

What’s The Near Term Outlook For More Incentives In Maryland?

The Free State is at the forefront of the solar revolution, and it seems many of its incentives will stick around for 2024 — with one exception.

Funds for Maryland’s Energy Storage Income Tax Credit for solar batteries have run out as of September 2022 and at this time it doesn’t seem like it will be extended. However, the Biden Administration created a 30% federal tax credit for solar energy storage as part of the Inflation Reduction Act, so Maryland residents will still be able to claim these funds as tax credits.

All of the other solar incentives in Maryland should stick around throughout 2024. However, it’s worth noting that many states — including California — are beginning to roll back their net metering programs. We can’t help but anticipate that Maryland may do the same at some point, so we recommend installing solar panels in Maryland sooner rather than later to capitalize on these benefits.